Investing in mutual funds through Systematic Investment Plans (SIPs) is like embarking on a financial journey with a well-thought-out roadmap. In this article, well explore how SIPs, when coupled with intelligent diversification within mutual funds, can pave the way for achieving optimal returns in a straightforward and effective manner.

Understanding SIPs in Mutual Funds

Systematic Investment Plans (SIPs) in mutual funds provide a disciplined approach to investing. Instead of a lumpsum investment, SIPs allow you to contribute a fixed amount at regular intervals, typically monthly. This systematic method not only promotes consistency in investing but also aligns with the goal of long-term wealth creation.

The essence of diversification

Diversification is a key principle that involves spreading your investments across different types of assets. In the context of mutual funds, this could mean investing in a variety of funds that cover different market sectors, asset classes, or investment styles. The primary goal is to reduce the risk associated with investing in a single asset or market segment.

Why diversify within mutual funds

Risk mitigation : Diversifying your mutual fund investments helps in managing risk. Various funds react differently to market changes. By having a mix of funds in your portfolio, the impact of poor performance in one fund may be offset by the positive performance of another.

Enhanced opportunities : Different types of mutual funds present distinct opportunities and risks. Intelligent diversification allows you to benefit from various market opportunities, potentially increasing the likelihood of capturing positive returns, even in fluctuating market conditions.

Stability amid volatility : Financial markets are known for their ups and downs. Diversifying within mutual funds can help mitigate the impact of market volatility. While certain funds may experience temporary declines, others might be more stable or even perform well, contributing to an overall balanced portfolio.

Crafting a diversified SIP portfolio

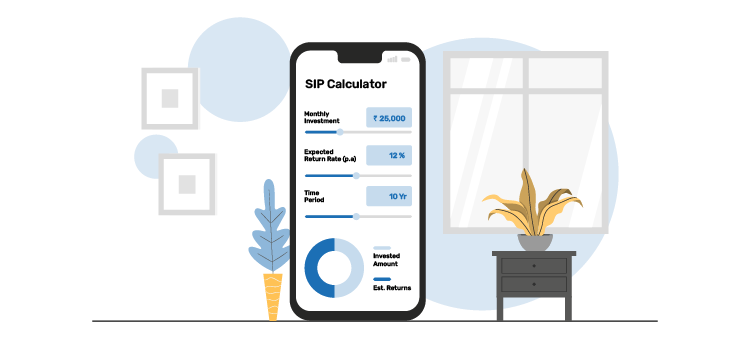

Set clear financial goals : Begin by defining your financial goals. Whether its saving for a home, education, or retirement, understanding your objectives will guide the selection of mutual funds that align with your aspirations. You can also use an online SIP calculator to determine your investment amount and time horizon for your specific financial goals.

Consider your risk tolerance : Assessing your risk tolerance is crucial. Different mutual funds come with varying levels of risk. Understanding how much risk you are comfortable with allows you to select funds that match your risk appetite.

Choose a mix of funds : Opt for a diverse mix of mutual funds. This may include equity funds for potential growth, debt funds for relative stability, and hybrid funds that combine both. The right mix depends on your goals, time horizon, and risk tolerance.

Regularly review and adjust : The financial landscape evolves, and so should your mutual fund portfolio. Regularly review your investments to ensure they align with your goals. Adjust your portfolio if needed, based on changes in market conditions or your financial objectives.

Avoid over concentration : While diversification is key, its equally important not to over concentrate in one type of fund. Spread your investments across various funds to ensure a balanced and well-diversified portfolio.

Conclusion

In conclusion, combining SIPs with intelligent diversification within mutual funds is a potent strategy for attaining optimal returns. By embracing the simplicity of SIPs and diversifying strategically, you can build a robust investment portfolio that aligns with your financial goals.

*Mutual Fund investments are subject to market risks, read all scheme related documents carefully.