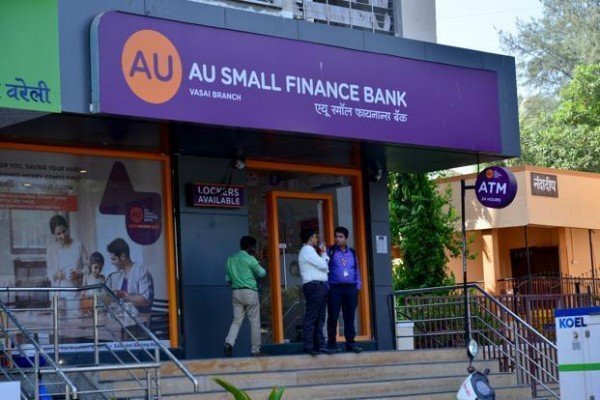

In a landmark move within the Indian banking sector, AU Small Finance Bank Ltd has announced its intention to merge with Fincare Small Finance Bank. This merger marks the first-ever amalgamation between two small finance banking institutions, representing a significant development in the financial landscape.

Under the proposed amalgamation plan, shareholders of Fincare Small Finance Bank will be entitled to receive 579 equity shares of AU Small Finance Bank Ltd for every 2,000 fully paid-up equity shares they currently hold. This exchange ratio is a pivotal aspect of the merger, determining how the shareholders of the merging entities will participate in the combined entity.

Both AU Small Finance Bank and Fincare Small Finance Bank were established with a core objective of promoting financial inclusion by providing avenues for savings and facilitating access to credit for small businesses, small and marginal farmers, micro and small industries, and other unorganized sector entities. These banks were established in accordance with the Reserve Bank of India’s (RBI) policy introduced in 2014.

AU Small Finance Bank commenced its operations in April 2017, while Disha Microfin, which later evolved into Fincare Small Finance Bank following a merger with Future Financial Services, began its operations in July 2017. Both entities have made significant strides in furthering financial inclusion and providing vital banking services to underserved segments of the population.

The merger plan is contingent upon several crucial approvals, including the consent of the shareholders of both the transferor company (Fincare Small Finance Bank Ltd) and the transferee company (AU Small Finance Bank Ltd). Additionally, the merger proposal requires the approval of the Reserve Bank of India (RBI) and the Competition Commission of India (CCI). These regulatory approvals are essential steps in the merger process, ensuring that it adheres to the regulatory framework and does not hinder market competition.

The scheme specifies that the appointed date for the merger is slated to be February 1, 2024, or a date mutually determined by both companies and sanctioned by the RBI. This date marks the official commencement of the integration process and the consolidation of the two banks into a unified entity.

As of September 30, AU Small Finance Bank reported total assets worth ₹95,977 crore and a net worth of ₹11,763 crore. In contrast, Fincare Small Finance Bank’s financials stood at total assets of ₹14,777 crore and a net worth of ₹1,539 crore. Notably, AU Small Finance Bank’s shares are listed on the stock exchanges, whereas Fincare Small Finance Bank had received approval from the Securities and Exchange Board of India (SEBI) for a share sale just last month.

The merger’s rationale, as outlined in a statement, hinges on the substantial synergies between the two small finance banks, particularly concerning their branch network, product offerings, and customer segments. This consolidation is driven by the prospect of achieving revenue synergy and growth, with a focus on leveraging the best practices in banking, technology, governance, and prudence from both banks. The merger is expected to result in a more robust platform that benefits all stakeholders, including customers, employees, and shareholders, while also taking advantage of economies of scale.

As of September 30, AU Small Finance Bank’s promoters held 25.49% of the bank, while Fincare Small Finance Bank’s promoters held 78.58% as of March 31. The merger holds the potential to reshape the landscape of small finance banking in India and offer enhanced services to customers in need of inclusive financial solutions.