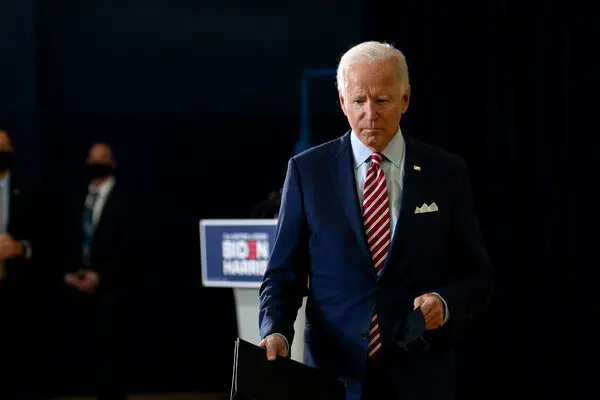

Oil prices saw a modest rise on Tuesday, October 17, with the market closely watching the upcoming visit of US President Joe Biden to the Middle East. This trip is expected to be a delicate balancing act, as it involves demonstrating support for Israel while also striving to prevent the Israel-Hamas conflict from escalating further. Biden’s visit is seen as an attempt to maintain a delicate equilibrium, showing solidarity with Israel’s stance against Hamas while working to garner support from Arab nations to help avert a larger regional conflict.

After experiencing a decline of over a dollar on the previous day, Brent crude oil futures managed to recover, increasing by $0.74 to reach $90.39 per barrel. Simultaneously, US West Texas Intermediate (WTI) crude also saw gains, rising by $0.69 to reach $87.35 per barrel. The ongoing concerns surrounding the Israel-Hamas conflict had a significant impact on both of these oil benchmarks, resulting in substantial gains the previous week. The global benchmark, Brent, witnessed an impressive 7.5 percent surge, marking its most significant weekly increase since February, according to Reuters.

Back in India, on the Multi Commodity Exchange (MCX), crude oil futures set to expire on October 19 were trading lower by 0.7 percent at ₹7,188 per barrel. During the session, these futures exhibited a volatile performance, fluctuating between ₹7,132 and ₹7,528 per barrel. This variation was observed in comparison to the previous closing price of ₹7,239 per barrel.

Several factors are at play in influencing crude oil prices. Iran, part of a network of nations known as the ‘resistance front,’ which includes the Hezbollah movement in Lebanon, has pledged to take pre-emptive action. This has been reported by Reuters and has led to market uncertainty. Analysts suggest that oil prices are currently wavering as energy traders closely monitor whether US diplomatic efforts will prove successful in averting the expansion of the Israel-Hamas conflict into a wider regional war.

A crucial factor contributing to these price fluctuations is the imposition of sanctions by the United States on oil exports from Venezuela since 2019. This South American nation is a member of the Organization of Petroleum Exporting Countries (OPEC). The sanctions were imposed as a punitive measure against President Nicolas Maduro’s government, following elections in 2018, which the US deemed to be a sham.

In recent times, the US government has been actively exploring strategies to increase the global flow of oil to mitigate the impact of rising prices. However, the reality is that any significant increase in oil output from Venezuela will require time, given the substantial lack of investment in the country’s oil infrastructure.

The Chief Executive Officer of Saudi Arabia’s state-owned oil company, Saudi Aramco, mentioned on Tuesday that the company has the capacity to swiftly ramp up oil production if required. This flexibility is essential, as global oil consumption is expected to reach a record high by the end of the year.

Regarding the trajectory of oil prices, analysts have observed a slight easing of WTI crude oil futures at the beginning of the week. This occurred as the United States intensified its diplomatic efforts to contain the Middle East crisis. The challenge lies in the fact that the US is confronted with a choice: it cannot simultaneously put pressure on Iranian and Russian oil sources, as doing so carries significant political risks for President Biden, especially in the lead-up to the 2024 Presidential election.

Furthermore, it has been reported that the US is considering the possibility of easing sanctions on Middle East Venezuela’s oil exports, contingent on the nation taking steps to ensure fair presidential elections in the near future. This development has introduced an element of uncertainty into the oil market. According to Ravindra Rao, a CMT and VP-Head of Commodity Research at Kotak Securities, “Oil prices were also under pressure amid reports that the US will ease sanctions on Venezuela’s oil exports in exchange for steps to ensure the country holds fair presidential elections next year.”